rex Celebrating 20 Years

It was a breath of fresh air that Rex didn’t decide to blame other carriers for the loss. What was it a 69m Looss up from 7m previous yr. COVID or no COVID I don’t think that’s all that good. LKH has given his predictions tho.

QF is out today that will be a whopping loss also.

VA had a spread in the paper, they’re delaying the float due to “state of the financial market” what are they masking?!

QF is out today that will be a whopping loss also.

VA had a spread in the paper, they’re delaying the float due to “state of the financial market” what are they masking?!

Rex with a 68 million dollar loss, not including the 32 million they received from the government, adds up to a 100 million operational loss on only 319 million revenue!!! They will have a long way to go to get back to profitability by FY23!!!!

Not great, not terrible, to borrow a line. A bit perplexing though when the accompanying ASX statement is far more focussed on talking up FY23 than addressing the FY22 results.

Any old how. $70 million operating loss, cash flows lookgood fair. The claimed full year after tax loss of $46 million is softened by their $40.7 million asset impairment reversal. Their pre-tax loss would have been over $100 million (essentially a third of revenue) without it.

Looks like someone finally realised that their jet service wasn't just going to sell itself; their marketing spend doubled over the previous year.

Jet ops looks like it has added about $30 million a year in salaries and related costs. Leasing costs are becoming more transparent; around $US120K per month per jet.

As the Zen Master was fond of saying, "We'll see."

Any old how. $70 million operating loss, cash flows look

Looks like someone finally realised that their jet service wasn't just going to sell itself; their marketing spend doubled over the previous year.

Jet ops looks like it has added about $30 million a year in salaries and related costs. Leasing costs are becoming more transparent; around $US120K per month per jet.

Barring further external shocks, I am confident that the group will return to good profitability in the 2023 financial year.

Last edited by MickG0105; 24th Aug 2022 at 22:14. Reason: Tidy up, added point for clarity

Join Date: Jul 2020

Location: New Zealand

Posts: 37

Likes: 0

Received 0 Likes

on

0 Posts

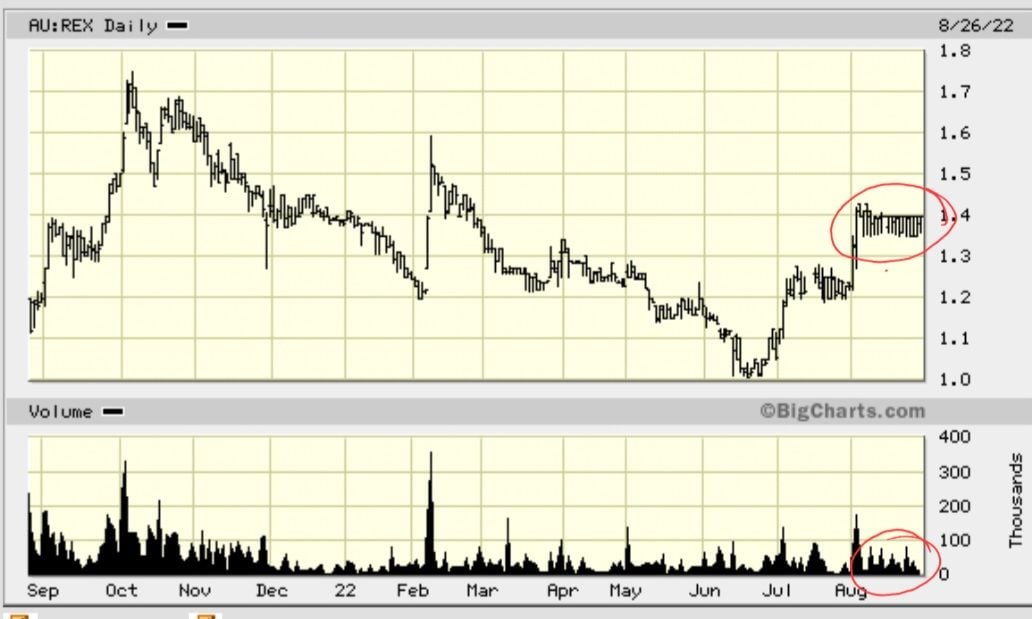

And that on a market cap of 154M. Similar real loss last year when you reverse out the handout. Share-price held up at about $1.40 on very low volume. A few weeks ago I watched the market cap go up by about 30M on a little more than 200k of shares. It has stayed there ever since with very low volume support.

With these high level of losses and the ability of the debt holders to convert the loans to equity, the real dilution of share value as to where it remains just doesn't make sense. As so much about Rex doesn't!

This is just a cursory opinion. I'll have a much closer look at the accounts over the coming week.

With these high level of losses and the ability of the debt holders to convert the loans to equity, the real dilution of share value as to where it remains just doesn't make sense. As so much about Rex doesn't!

This is just a cursory opinion. I'll have a much closer look at the accounts over the coming week.

And that on a market cap of 154M. Similar real loss last year when you reverse out the handout. Share-price held up at about $1.40 on very low volume. A few weeks ago I watched the market cap go up by about 30M on a little more than 200k of shares. It has stayed there ever since with very low volume support.

With these high level of losses and the ability of the debt holders to convert the loans to equity, the real dilution of share value as to where it remains just doesn't make sense. As so much about Rex doesn't!

This is just a cursory opinion. I'll have a much closer look at the accounts over the coming week.

With these high level of losses and the ability of the debt holders to convert the loans to equity, the real dilution of share value as to where it remains just doesn't make sense. As so much about Rex doesn't!

This is just a cursory opinion. I'll have a much closer look at the accounts over the coming week.

Join Date: Jul 2020

Location: New Zealand

Posts: 37

Likes: 0

Received 0 Likes

on

0 Posts

Share price is absolutely critical to them with regards to the PAG funding. The associated secured convertible notes are set at $1.50 a share. Any time Rex draws down on the PAG funding with their shares below $1.50 they have to stump up the difference in cash. When their shares were in the $1.10 range it essentially put the PAG funds out of reach.

PAG wont give two hoots about share price for at least another year, unless it completely tanks. Loss seems totally in line with conditions and current expansion trajectory. Its also quite obvious from the QF loss that the flight credits as talked about earlier are completely distorting the market. That is people are hooked in QF and VA to redeem owed credits, once that dies down over the next year or two the market will be more open to choice. Rex loads over the last year are more indicative of what was left of the real market rather than long term indicators. Which is why rex forward bookings are rising and management are confident.

So REX has posted a loss which was always on the cards, remembering the REX jet shutdown, the false starts and 2021 boarder closures along with the attack by QF

So what changes for REX moving forward, a 50% increase in the REX jet fleet as QF/JQ cuts flights and increases fares by 20% with the aim of getting 95% loads LMFAO

Perhaps they could also exit Broken Hill, Orange, Cooma, Merimbula and a few others that the threw QLink onto to hurt REX, note that they waived the white flag at Mt Gambier and Albury to Melbourne

Any one know how much QF/JQ spent trying to eliminate REX ?

FFS QF/JQ would be better off getting their own product right as they are now just gifting passengers to REX

OTP. cancellations, lost baggage and falling staff morale are but a few of their issues

Jets today

328 SYD BNE 139 Y

348 SYD BNE 146 Y

202 MEL BNE 151 Y

258 MEL BNE 164 Y

616 MEL CBR 90 Y

658 MEL OOL 146 Y

437 MEL ADL 112 Y

489 MEL ADL 136 Y

018 MEL SYD 133 Y

042 MEL SYD 140 Y

132 MEL SYD 162 Y

152 MEL SYD 120 Y

182 MEL SYD 130 Y

540 SYD OOL 150 Y

Average 136.1 = 81% load

Last Friday was 128.3 = 76%

Jets trending up 5%

So what changes for REX moving forward, a 50% increase in the REX jet fleet as QF/JQ cuts flights and increases fares by 20% with the aim of getting 95% loads LMFAO

Perhaps they could also exit Broken Hill, Orange, Cooma, Merimbula and a few others that the threw QLink onto to hurt REX, note that they waived the white flag at Mt Gambier and Albury to Melbourne

Any one know how much QF/JQ spent trying to eliminate REX ?

FFS QF/JQ would be better off getting their own product right as they are now just gifting passengers to REX

OTP. cancellations, lost baggage and falling staff morale are but a few of their issues

Jets today

328 SYD BNE 139 Y

348 SYD BNE 146 Y

202 MEL BNE 151 Y

258 MEL BNE 164 Y

616 MEL CBR 90 Y

658 MEL OOL 146 Y

437 MEL ADL 112 Y

489 MEL ADL 136 Y

018 MEL SYD 133 Y

042 MEL SYD 140 Y

132 MEL SYD 162 Y

152 MEL SYD 120 Y

182 MEL SYD 130 Y

540 SYD OOL 150 Y

Average 136.1 = 81% load

Last Friday was 128.3 = 76%

Jets trending up 5%

So REX has posted a loss which was always on the cards, remembering the REX jet shutdown, the false starts and 2021 boarder closures along with the attack by QF

So what changes for REX moving forward, a 50% increase in the REX jet fleet as QF/JQ cuts flights and increases fares by 20% with the aim of getting 95% loads LMFAO

Perhaps they could also exit Broken Hill, Orange, Cooma, Merimbula and a few others that the threw QLink onto to hurt REX, note that they waived the white flag at Mt Gambier and Albury to Melbourne

Any one know how much QF/JQ spent trying to eliminate REX ?

FFS QF/JQ would be better off getting their own product right as they are now just gifting passengers to REX

OTP. cancellations, lost baggage and falling staff morale are but a few of their issues

Jets today

328 SYD BNE 139 Y

348 SYD BNE 146 Y

202 MEL BNE 151 Y

258 MEL BNE 164 Y

616 MEL CBR 90 Y

658 MEL OOL 146 Y

437 MEL ADL 112 Y

489 MEL ADL 136 Y

018 MEL SYD 133 Y

042 MEL SYD 140 Y

132 MEL SYD 162 Y

152 MEL SYD 120 Y

182 MEL SYD 130 Y

540 SYD OOL 150 Y

Average 136.1 = 81% load

Last Friday was 128.3 = 76%

Jets trending up 5%

So what changes for REX moving forward, a 50% increase in the REX jet fleet as QF/JQ cuts flights and increases fares by 20% with the aim of getting 95% loads LMFAO

Perhaps they could also exit Broken Hill, Orange, Cooma, Merimbula and a few others that the threw QLink onto to hurt REX, note that they waived the white flag at Mt Gambier and Albury to Melbourne

Any one know how much QF/JQ spent trying to eliminate REX ?

FFS QF/JQ would be better off getting their own product right as they are now just gifting passengers to REX

OTP. cancellations, lost baggage and falling staff morale are but a few of their issues

Jets today

328 SYD BNE 139 Y

348 SYD BNE 146 Y

202 MEL BNE 151 Y

258 MEL BNE 164 Y

616 MEL CBR 90 Y

658 MEL OOL 146 Y

437 MEL ADL 112 Y

489 MEL ADL 136 Y

018 MEL SYD 133 Y

042 MEL SYD 140 Y

132 MEL SYD 162 Y

152 MEL SYD 120 Y

182 MEL SYD 130 Y

540 SYD OOL 150 Y

Average 136.1 = 81% load

Last Friday was 128.3 = 76%

Jets trending up 5%

Yup on that trend basis theyíll be at 111% Load factors in 6 weeks 👍

how suspicious is the share price at the moment. It miraculously dips every morning to return to $1.4 by close.

ASX graph has the price holding steady since it hit $1.40 +- a few cents, nothing to see there. Very low volumes so just normal trading. Or are you alluding that somebody is trying to manipulate the price lower and failing?

Could just be somebody has an automatic trigger to buy anything under $1.40, somebody posts a trade at $1.35 and it gets snapped up and all other trades until its back up to $1.40 then they stop buying. There's a lot of automated stock market transactions. Just suck to be the person selling at $1.35 when they could have got $1.40. Reverse if you are stupid enough to sell well below valuation then somebody will shark them and put them back on the market straight away at the higher market value, instant profit for no work.

Not sure what the excitement is, but the last few weeks the ASX has been flat, with Rex shares pretty much pacing with it the last 5 days on comparison. Looks odd but generally the company results are totally in line with what the market expected from the look of it so no one of note batted an eyelid and probably just some minor trades going on.