rex Celebrating 20 Years

Numbers for today

Looking at one direction only, but just for Mick I will add 549 OOL-SYD

Yea it's Friday so numbers should be up...

658 MEL OOL 146

437 MEL ADL 124

489 MEL ADL 77

202 MEL BNE 131

258 MEL BNE 148

540 SYD OOL 129

616 MEL CBR 88

328 SYD BNE 104

348 SYD BNE 134

384 SYD BNE 103

018 MEL SYD 154

132 MEL SYD 158

152 MEL SYD 118

182 MEL SYD 103

549 OOL SYD 105

Average 122 + whatever up front 73% (that's on 168 economy) perhaps they made a bit today.....

Mick

30 @1.6hours? Maybe on MEL-CBR, allowing for 30 minutes turn around, REX is doing 61 hours per day, assuming all 6 flying, 10 hours per day each, perhaps this could be higher, but look at their on time performance verses QF, may be a better way to operate rather than having no give in the schedules

6 months?! WTF are you talking about? The recovery in domestic aviation activity has been running largely unimpeded for over 12 months now. Activity has more than quadrupled over that period

Looking back through rosy coloured glasses Mick

November 2020 first 737 delivered

March 2021 REX jet starts

April 2021 fleet now 6

July 2021 lockdowns and border closured

September 2021 REX suspends REX jet service due border closures and lockdowns

October 2021 restart begins

December 2021 Brisbane begins

So 9 months since restart and no airline kicked off with 100% of 2019 capacity

70% break even is reasonable, but for over a decade REX has been making a profit with well under this, perhaps 60%

And I bet they have paid more company tax than QF has over the past 10 years

Looking at one direction only, but just for Mick I will add 549 OOL-SYD

Yea it's Friday so numbers should be up...

658 MEL OOL 146

437 MEL ADL 124

489 MEL ADL 77

202 MEL BNE 131

258 MEL BNE 148

540 SYD OOL 129

616 MEL CBR 88

328 SYD BNE 104

348 SYD BNE 134

384 SYD BNE 103

018 MEL SYD 154

132 MEL SYD 158

152 MEL SYD 118

182 MEL SYD 103

549 OOL SYD 105

Average 122 + whatever up front 73% (that's on 168 economy) perhaps they made a bit today.....

Mick

30 @1.6hours? Maybe on MEL-CBR, allowing for 30 minutes turn around, REX is doing 61 hours per day, assuming all 6 flying, 10 hours per day each, perhaps this could be higher, but look at their on time performance verses QF, may be a better way to operate rather than having no give in the schedules

6 months?! WTF are you talking about? The recovery in domestic aviation activity has been running largely unimpeded for over 12 months now. Activity has more than quadrupled over that period

Looking back through rosy coloured glasses Mick

November 2020 first 737 delivered

March 2021 REX jet starts

April 2021 fleet now 6

July 2021 lockdowns and border closured

September 2021 REX suspends REX jet service due border closures and lockdowns

October 2021 restart begins

December 2021 Brisbane begins

So 9 months since restart and no airline kicked off with 100% of 2019 capacity

70% break even is reasonable, but for over a decade REX has been making a profit with well under this, perhaps 60%

And I bet they have paid more company tax than QF has over the past 10 years

Mick

30 @1.6hours? Maybe on MEL-CBR, allowing for 30 minutes turn around, REX is doing 61 hours per day, assuming all 6 flying, 10 hours per day each, perhaps this could be higher, but look at their on time performance verses QF, may be a better way to operate rather than having no give in the schedules

30 @1.6hours? Maybe on MEL-CBR, allowing for 30 minutes turn around, REX is doing 61 hours per day, assuming all 6 flying, 10 hours per day each, perhaps this could be higher, but look at their on time performance verses QF, may be a better way to operate rather than having no give in the schedules

With a bit of luck whoever explains block hours might also be able to explain to you how utilisation is calculated. Then you might grasp that Rex are currently under utilising their current fleet.

You break even when your revenue matches your costs. The cost base for owned, 25 year old turboprops operating in and out of regional strips is markedly different to leased jets flying in and out of major airports. That cost difference alone will shift the break even point given as load factor. I suspect that a 10 year old would probably grasp that.

In any event, one minute you were saying a 70 percent load factor was the break-even point, a day later you had that down to 60 percent. You appear to have NFI what you are talking about ... and you appear that way routinely on a very wide and expanding range of topics.

I'll take that bet. What are you putting up as your stake?

You seem determined to continually better yourself in the most stupid statement of the day stakes. Of some concern is that it wouldn't have taken you 20 minutes of skimming through annual reports to determine that Qantas paid more than three times as much in company tax in just one year, FY19, than Rex has paid in aggregate over the past 10 years.

You couldn't have expended even that amount of effort to avoid coming across as an idiot?

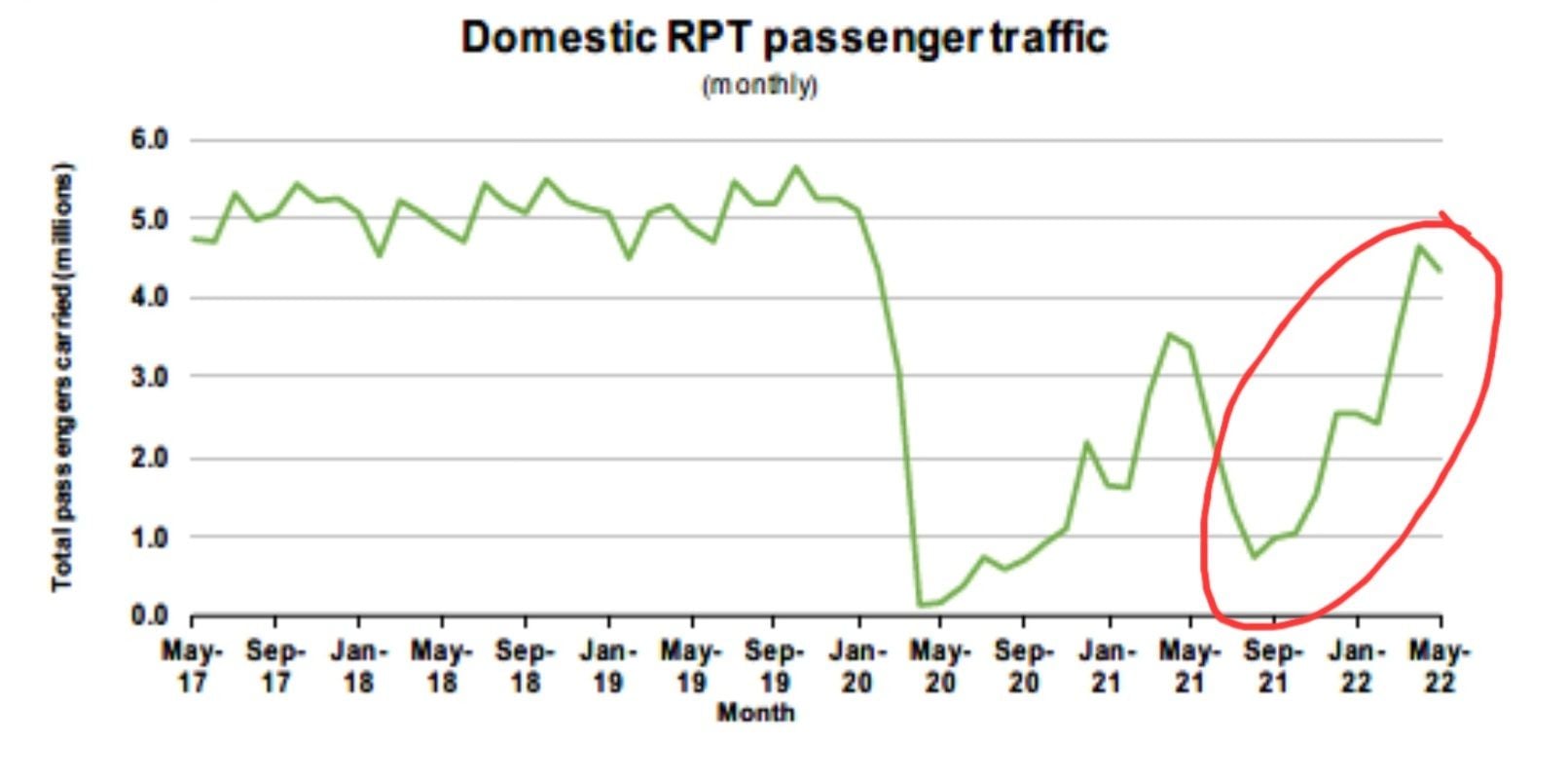

Thanks for attaching the graph to tour post Mick

Totally backs up my point and discredits yours

By your own graph we have not been running 12 months unimpeded

We are in August 2022

By your graph we bottomed out in August 2021 at around 20% of 2019

Nov-Dec barely made it to 50% pre-covid and REX jet still grounded

This 50% remained for 2 months due to the beginning of omicron propped up by the holidays

This 50% lagged through February

March to August saw the main recovery which is 6 months

And as for activity quadrupling when you are coming of such a depressed base, that is no surprise

As for break even

REX has continually stated that their 737 operating costs are lower that even JQ

What their actual break even is I really don't know, but 70% would be close to the mark

Totally backs up my point and discredits yours

By your own graph we have not been running 12 months unimpeded

We are in August 2022

By your graph we bottomed out in August 2021 at around 20% of 2019

Nov-Dec barely made it to 50% pre-covid and REX jet still grounded

This 50% remained for 2 months due to the beginning of omicron propped up by the holidays

This 50% lagged through February

March to August saw the main recovery which is 6 months

And as for activity quadrupling when you are coming of such a depressed base, that is no surprise

As for break even

REX has continually stated that their 737 operating costs are lower that even JQ

What their actual break even is I really don't know, but 70% would be close to the mark

Seeing you’re in the know, what’s JQ operating cost? Rex wouldn’t know what JQ operating cost anymore than they would know what powerball numbers will be on Thursday night.

but, I’d love to know as it would really help us out for data compilation to the company with current discussions.

but, I’d love to know as it would really help us out for data compilation to the company with current discussions.

I am guessing that since Rex pays lower wages to crew and obviously don’t have a marketing department then their costs would be lower. I recall some initial crowing from Sharpe about low lease costs too, but that likely isn’t the case now.

What that graph shows is that since the nadir in passenger numbers in August last year, for the significant majority of the past 12 months we have seen improving passenger numbers month-on-month (ie an ongoing recovery in domestic aviation activity). There have been just two months - February and May this year - where passenger numbers went backwards (ie where the recovery was impeded). In other words, over the past twelve months, the recovery in passengers numbers has been largely unimpeded. And that graph illustrates that point.

Forbes looked at this for a handful of US airlines last year; Southwest's break-even was around 72.5 percent. IATA looked at this in 2020 when social distancing proposals were going to significantly impact achievable load factors; the average break-even load factor across a sample of 122 airlines was 77 percent. Only 18 or so of the 122 sample broke even at 70 percent or less.

And just by the bye, Rex stating something, particularly continually, is probably a good indication that it is likely not correct. We know that Rex pays their crews less than Jetstar. It is highly unlikely that Rex is paying less for fuel than Jetstar.

If Rex can break-even with 70 percent loads I'd be surprised. Apart from anything else, that would put them in the top quintile of operators globally, essentially best-in-class. Do they strike you as a best-in-class operator? In any event, for the week just gone to Friday, they weren't even managing 60 percent for their jet ops.

Separately, where are we at with that bet on corporate taxes?

Last edited by MickG0105; 12th Aug 2022 at 23:13. Reason: Tidy up

Mick in what world, where REX suspends jet ops for 3 months, border closures, lockdowns and omicron surge, is this a largely unimpeded period?

Your graph from August to October a mere 20% of per covid was achieved

Your graph shows that by December we had not even hit 50% of pre covid, hardly ideal operating conditions

Your graph shows a decline in January and February, which you have begrudgingly conceded, and we are still under 50%

Your graph shows that by April we are getting closer to normality at around 80%

For some strange reason on an earlier post you have implied massive growth of 400% over this period, not growth Mick, recovery, big difference

As for break even, few really know what that numbers really is

Obviously for the likes of SW this number would be higher being a LCC over a lean legacy carrier, but it's good that you have conceded that there are plenty breaking even at 70% or less

Being new to jet ops, REX does not have the baggage of older legacy carriers and as they have come in clean sheet, for example, they would not have had to worry about converting to outsourced ground handling or maintenance as this would have been the case from the get go, nor would they have old expensive leases trailing off

So yes, being in the top percentile is very likely where they are at

Do they strike me as being best in class?

They are in OTP

They are in passenger experience

They are in value for money

They say that they are on efficiency

No FFPs and lounges a bit average on the downside

Taxes? remember 2013s multi billion dollar loss/write-down then for years after no tax on profits

Your graph from August to October a mere 20% of per covid was achieved

Your graph shows that by December we had not even hit 50% of pre covid, hardly ideal operating conditions

Your graph shows a decline in January and February, which you have begrudgingly conceded, and we are still under 50%

Your graph shows that by April we are getting closer to normality at around 80%

For some strange reason on an earlier post you have implied massive growth of 400% over this period, not growth Mick, recovery, big difference

As for break even, few really know what that numbers really is

Obviously for the likes of SW this number would be higher being a LCC over a lean legacy carrier, but it's good that you have conceded that there are plenty breaking even at 70% or less

Being new to jet ops, REX does not have the baggage of older legacy carriers and as they have come in clean sheet, for example, they would not have had to worry about converting to outsourced ground handling or maintenance as this would have been the case from the get go, nor would they have old expensive leases trailing off

So yes, being in the top percentile is very likely where they are at

Do they strike me as being best in class?

They are in OTP

They are in passenger experience

They are in value for money

They say that they are on efficiency

No FFPs and lounges a bit average on the downside

Taxes? remember 2013s multi billion dollar loss/write-down then for years after no tax on profits

If they were anything less than the best with OTP operating only 6 jets, Rex would have a serious problem. Let’s see their OTP and experience if they ever get over 11 jets. Still, no can seem to answer their biggest looming problem slots into SY?! This time next yr I’m sure international will be back 100% and not a slot to spare.

Mick in what world, where REX suspends jet ops for 3 months, border closures, lockdowns and omicron surge, is this a largely unimpeded period?

Your graph from August to October a mere 20% of per covid was achieved

Your graph shows that by December we had not even hit 50% of pre covid, hardly ideal operating conditions

Your graph shows a decline in January and February, which you have begrudgingly conceded, and we are still under 50%

Your graph shows that by April we are getting closer to normality at around 80%

Your graph from August to October a mere 20% of per covid was achieved

Your graph shows that by December we had not even hit 50% of pre covid, hardly ideal operating conditions

Your graph shows a decline in January and February, which you have begrudgingly conceded, and we are still under 50%

Your graph shows that by April we are getting closer to normality at around 80%

The fact that Rex navigated that recovery poorly is a testament to their poor management.

Activity has more than quadrupled over that period.

As for break even, few really know what that numbers really is

Obviously for the likes of SW this number would be higher being a LCC over a lean legacy carrier, but it's good that you have conceded that there are plenty breaking even at 70% or less

Being new to jet ops, REX does not have the baggage of older legacy carriers and as they have come in clean sheet, for example, they would not have had to worry about converting to outsourced ground handling or maintenance as this would have been the case from the get go, nor would they have old expensive leases trailing off

So yes, being in the top percentile is very likely where they are at

Obviously for the likes of SW this number would be higher being a LCC over a lean legacy carrier, but it's good that you have conceded that there are plenty breaking even at 70% or less

Being new to jet ops, REX does not have the baggage of older legacy carriers and as they have come in clean sheet, for example, they would not have had to worry about converting to outsourced ground handling or maintenance as this would have been the case from the get go, nor would they have old expensive leases trailing off

So yes, being in the top percentile is very likely where they are at

And just by the bye, the legacy carriers in the Forbes study - American, Delta and United - all had higher break-even load factors than Southwest.

And Rex, in the top ten percent of airlines from around the world?! Seriously? Today, on one of the busiest air routes in the world, they finished flying before lunch. With a fleet of six jets they will mount 19 flights today. None of that is consistent with a top decile operator.

How about this? Either put up or shut up on your inane tax bet. If you think you're right, just post the data. If you're right, I won't post on this thread again. If you're wrong, you don't post on this thread again. How's that?

Last edited by MickG0105; 13th Aug 2022 at 09:47. Reason: Typo, corrected for courtesy

QF paid $253 million in 2019

Nothing from 2013-2018

$42.16 million p/a

REX paid between $2 and $3 million per year over this period

Pro rata REX fleet over this period was 50 odd SAABs for 1700 available seats

Where as QF/JQ

A330 200 4698 seats

A330 300 2970 seats

A380 800 5640 seats

737 800 13000 odd seats

Plus maybe 3000 in 747s

JQ

58 odd A320/321 10500

11 787 8 3600

+ QLink Network and NJS say another 10000

Total carrying capacity around 54,000

So being over 30 x larger by carrying capacity REX pro-rata (even on $2million p/a) would have paid over $360million verses QF/JQs $253million

Gotta compare apples with apples

Or

For 5 out of 6 years REX did pay more than QF/JQ as QF/JQ paid no corporate tax what so ever

Nothing from 2013-2018

$42.16 million p/a

REX paid between $2 and $3 million per year over this period

Pro rata REX fleet over this period was 50 odd SAABs for 1700 available seats

Where as QF/JQ

A330 200 4698 seats

A330 300 2970 seats

A380 800 5640 seats

737 800 13000 odd seats

Plus maybe 3000 in 747s

JQ

58 odd A320/321 10500

11 787 8 3600

+ QLink Network and NJS say another 10000

Total carrying capacity around 54,000

So being over 30 x larger by carrying capacity REX pro-rata (even on $2million p/a) would have paid over $360million verses QF/JQs $253million

Gotta compare apples with apples

Or

For 5 out of 6 years REX did pay more than QF/JQ as QF/JQ paid no corporate tax what so ever

QF paid $253 million in 2019

Nothing from 2013-2018

$42.16 million p/a

REX paid between $2 and $3 million per year over this period

Pro rata REX fleet over this period was 50 odd SAABs for 1700 available seats

Where as QF/JQ

A330 200 4698 seats

A330 300 2970 seats

A380 800 5640 seats

737 800 13000 odd seats

Plus maybe 3000 in 747s

JQ

58 odd A320/321 10500

11 787 8 3600

+ QLink Network and NJS say another 10000

Total carrying capacity around 54,000

So being over 30 x larger by carrying capacity REX pro-rata (even on $2million p/a) would have paid over $360million verses QF/JQs $253million

Gotta compare apples with apples

Or

For 5 out of 6 years REX did pay more than QF/JQ as QF/JQ paid no corporate tax what so ever

Nothing from 2013-2018

$42.16 million p/a

REX paid between $2 and $3 million per year over this period

Pro rata REX fleet over this period was 50 odd SAABs for 1700 available seats

Where as QF/JQ

A330 200 4698 seats

A330 300 2970 seats

A380 800 5640 seats

737 800 13000 odd seats

Plus maybe 3000 in 747s

JQ

58 odd A320/321 10500

11 787 8 3600

+ QLink Network and NJS say another 10000

Total carrying capacity around 54,000

So being over 30 x larger by carrying capacity REX pro-rata (even on $2million p/a) would have paid over $360million verses QF/JQs $253million

Gotta compare apples with apples

Or

For 5 out of 6 years REX did pay more than QF/JQ as QF/JQ paid no corporate tax what so ever

Everything we talk about is void if the Singaporeanís wish to p!ss cash down the drain for the next decade. They have a good history of doing that here. What should sink this is poor performance over many years, what will probably sink it is high fuel prices or something later down the track that gives a management a chance to save face.

God, people getting all antsy over whether the Rex startup is losing money or not. Who cares, its barely out of its second year and numbers are obviously improving, slowly but definitely on the up, which means return business and possibly profitability in the future. The last year of airline business loads mean just about nothing, we have no idea who's paying cash and who's just using the credits. The QF group refused refunds so they have a massive backlog of flight credits, some worth tens of thousands that customers are using up, VA would have similar liabilities. Rex was one of the few that allowed refunds in lieu of credits. This issue of using up credits will affect loads for the next year or two to come for the large players. At least there's a good chance that most passengers on a Rex flight are actually paying for it and not using credits, loyalty points or anything in between. Once those credits are funneled out of the system passengers will exercise more choice with who they fly with, then we'll get a real idea of who's the preferred airline in Australia. Throw in a multitude of other things and Rex is probably doing OK given the situation, from what I hear of the SAAB operation its been overloaded across the network with full flights regularly, which is not the norm, as said before typical large profit LFs of around 50-60% as per the financials.

PS I've heard of a heap of QF credits for international flights around $10k, where they have decided to can the overseas travel and are just whittling the amount away on domestic flights, if that gives some idea how long these credits might be filling seats.

PS I've heard of a heap of QF credits for international flights around $10k, where they have decided to can the overseas travel and are just whittling the amount away on domestic flights, if that gives some idea how long these credits might be filling seats.

Last edited by 43Inches; 13th Aug 2022 at 07:53.

QF paid $253 million in 2019

Nothing from 2013-2018

$42.16 million p/a

REX paid between $2 and $3 million per year over this period

Pro rata REX fleet over this period was 50 odd SAABs for 1700 available seats

Where as QF/JQ

A330 200 4698 seats

A330 300 2970 seats

A380 800 5640 seats

737 800 13000 odd seats

Plus maybe 3000 in 747s

JQ

58 odd A320/321 10500

11 787 8 3600

+ QLink Network and NJS say another 10000

Total carrying capacity around 54,000

So being over 30 x larger by carrying capacity REX pro-rata (even on $2million p/a) would have paid over $360million verses QF/JQs $253million

Gotta compare apples with apples

Or

For 5 out of 6 years REX did pay more than QF/JQ as QF/JQ paid no corporate tax what so ever

Nothing from 2013-2018

$42.16 million p/a

REX paid between $2 and $3 million per year over this period

Pro rata REX fleet over this period was 50 odd SAABs for 1700 available seats

Where as QF/JQ

A330 200 4698 seats

A330 300 2970 seats

A380 800 5640 seats

737 800 13000 odd seats

Plus maybe 3000 in 747s

JQ

58 odd A320/321 10500

11 787 8 3600

+ QLink Network and NJS say another 10000

Total carrying capacity around 54,000

So being over 30 x larger by carrying capacity REX pro-rata (even on $2million p/a) would have paid over $360million verses QF/JQs $253million

Gotta compare apples with apples

Or

For 5 out of 6 years REX did pay more than QF/JQ as QF/JQ paid no corporate tax what so ever

Now you're trying to crab walk your way away from your bet with a weasel-worded response. As pathetic as it is shameless. There are few things worse than people who can't be taken at their word.

Last edited by MickG0105; 13th Aug 2022 at 09:48. Reason: Tidied up for courtesy

Mick, regardless of who you agree with, or who is right or wrong, I donít think you should be insulting someone constantly.

I believe a moderator should be having a word to you regarding your choice of words. Itís ineffective.

I believe a moderator should be having a word to you regarding your choice of words. Itís ineffective.